This is the seventh blog in our series on optimising your mental wellbeing. As Wednesday 14 August 2024 is National Financial Awareness Day, this is a particularly poignant time to focus on what we can do to support our mental health through optimising our financial wellbeing.

The Money and Pensions Service defines financial wellbeing as ‘feeling secure and in control. It’s about making the most of your money from day to day, dealing with the unexpected, and being on track for a healthy financial future. In short: financially resilient, confident and empowered’. [1]

However, it will come as no surprise that recent surveys have found that:

- ‘75% of UK workers express concern over the rising cost of living’. [2]

- ‘59% said that the cost-of-living crisis has negatively impacted their mental health in the last year.’ [3]

- ‘46% said their physical wellbeing also suffered with people citing financial stress as the cause of their hair loss, weight issues and an overall sense of ageing’. [4]

Why is financial wellbeing important for mental health?

As can be seen by the statistics above, finances are one of the biggest causes of stress, anxiety or depression for many people. The financial concerns do not, necessarily, have to be related to debt (for many people their mortgage is the largest debt they have), the issue here is about being able to meet financial commitments. It is about having the confidence to be able to pay the monthly mortgage or rent payments, household bills, day-to-day living expenses etc. Financial wellbeing is also about having choice about how you spend your money.

There is no shame in experiencing financial hardship, it can, and does, affect anyone. However, if left unaddressed it can add further stress, anxiety or depression. It can also lead to disturbed sleep, reduced sense of self-worth and self-esteem, trouble concentrating, making decisions and problem-solving, and impact on relationships. Financial instability can also impact physical health, e.g., headaches, muscle tension, digestive problems, and elevated blood pressure.

Research has found that when you combine stressors, for example, financial concerns, with a lack of sleep, it can reduce someone’s IQ by 13 points. ‘It’s arguably the case that lack of finances – or financial stress – combined with associated lack of sleep, can have an enormous impact on the ability to think clearly and make rational decisions.’ [5]

What tips are there for improving our financial wellbeing?

The first thing to do, and possibly one of the hardest, is to be totally honest with yourself. Admitting that there is a problem is the first step and as part of this it means reading your statements/checking accounts online (bank, credit card, utilities etc.) so that you are fully appraised of your financial situation.

Secondly, James Carter of the walking and mental health business Green Man Walks notes it is also important to consider the wider support and work that can be done personally to build resilience and control in our finances, “Speaking to friends and family about financial challenges can be a huge relief while also reducing personal feelings of inadequacy, uselessness or powerlessness. This, alongside a clear plan, will ensure that those who care for you are present and supportive while you focus on the work of getting things back on track.”

In this blog, we aim to provide some guidance on how to control your outgoings and manage your debt. Below we have created guidance on tracking your income and expenses and provided a sample table in which to record them.

Income vs expenses

The next step is investigating all of your outgoings and writing them down – including those extra little spends that are easy to forget about, e.g., don’t just add up the weekly food bills, but also those smaller in between shops to pick up essentials. Nowadays it is easier to track expenditure as almost all transactions are by card – but don’t forget to add up all the cash payments too. Why not keep all your daily/weekly receipts and log them on an excel sheet or in a notebook so you can keep an accurate record and average out the expenses that vary weekly.

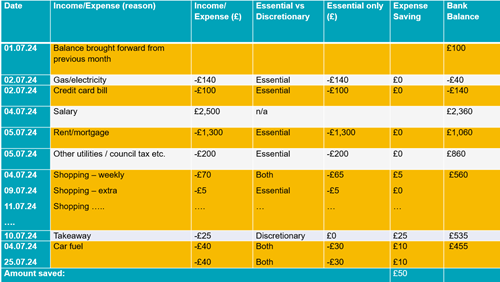

Once you have identified all of your expenses, it is important to consider which are essential versus which are discretionary. Some expenses may be easy to allocate, but what about the big shops – how often has something been thrown in the trolley as a ‘treat’ or because one of your children has pulled it off the shelf when you weren’t looking? This could also be applied to fuel – how often have you jumped in the car to nip to the shops when it would have been possible to walk? Again, keeping receipts will help identify what was essential versus discretionary – so in a third column break down the expense type. The table below is just an example, but might help to kick start your thought process:

Table 1: Monthly household income and expenses

Ways to save money

The table above shows when you receive your income as well as your expenses and when they go out. In the example above, the gas and credit card bills go out before the household salaries are received, creating a negative bank balance at the start of every month, which may result in the bank charging interest. The options here are to:

- Speak to the bank and arrange an overdraft – some banks offer free overdrafts up to a certain amount and reduced fees if pre-arranged up to a higher value.

- Speak to the companies (in the example above, this would be the gas/electricity provider and credit card company) and ask if your direct debit can be moved to a date after you receive your salary.

The table and tips above also work if you are paid weekly – just add in the dates on which you are paid and follow the rest of the format to see where savings can be made. However, these tips are based on income being received on fixed dates – if you are self-employed or on zero contract hours this may not be the case. If you are self-employed, start with agreeing strict payment terms on invoices (where possible) and try to set aside time to get your invoices out to ensure prompt payment, to enable you to pay yourself ahead of big outgoings.

It is also important to acknowledge and track any debts. In the same way as above, draw out a table with what you owe (mortgage, credit cards, bank loans, overdrafts etc.) and how much that is costing you each month. Whilst you cannot just stop paying the mortgage, many providers are open to talking to you if you are struggling with your repayments and may be able to offer support. Equally, you could talk to your credit card provider and if they are unable to help, then look for a provider that is offering a lower interest rate. By transferring your credit card debt to another provider, you may reduce your monthly outgoings.

Finally, examine the discretionary spend - where could you save money? This could be removing items that are not essential, e.g., subscription to a magazine or TV package; or saving money, e.g., through fixing your energy tariff. There may be some ‘swaps’ you can do. As we have seen in our blog on ‘being active’, being outdoors and exercising are both important elements in wellbeing, but if your budget cannot run to a gym membership, why not join a park run, make use of the free gym equipment in public places, e.g., your local park, or even get your friends together for a weekend walk.

Remember, mental wellbeing is made up of many components (as can be seen from our blog series), and it is important to remember that it includes self-care. Therefore, whilst trying to cut out discretionary spend, don’t forget to keep in some treats, be that food, drink, activities, which make your whole-self happy.

Ways to increase income

Have you checked to see if you are entitled to any benefits, including Universal Credit, as well as benefits such as carers’ allowance, warm home discounts, tax free childcare? If you are unsure as to your eligibility, both the government and Citizens Advice have handy benefits calculators.

For many it is not possible to get a second job, certainly not on a permanent basis, but look out for short term contracts that may help to increase your bank balance from time to time, e.g., working at a polling station, helping with census collections, undertaking surveys in your local area, or in a shop during busy periods e.g., in the run up to Christmas.

If or when finances enable you to, start to put money away for any unexpected expenditure or for your retirement. Don’t forget to use your tax allowances to ensure you pay less tax on any income you make from investments.

Where to get financial advice

If you are in debt, there are ways to manage it, e.g., through a repayment plan, there is great advice and help on the StepChange website.

MoneyHelper has lots of useful guidance and tools including a ‘budget planner’. Citizens Advice is another good source of support.

How employers can support financial wellbeing

Financial wellbeing is good for the individual, employer, community and economy.

‘In 2018, 11% of UK workers reported they had experienced a fall in productivity at some point over the preceding three years as a result of their financial situation’. [6]

Research has ‘found only half of UK firms had a financial wellbeing strategy in place’ [7], so this would be a good place to start in building support for employees. Guidance on how to create this can be found on the CIPD website.

If you employ sub-contractors or work with supply chains, please remember to pay your invoices promptly to reduce their financial uncertainty.

Next steps

In this blog we have looked at how financial wellbeing can help to optimise your mental health. The next blog in the series will be on how to support the mental wellbeing of those around you and will be published in September.

If you would like to be kept informed about our new blogs, resources, training and more, please sign up to our newsletter at the bottom of this page.

If you have enjoyed reading this blog, please share a link to it on your social media channels and if you are able to, we would really appreciate you finding out how you can support us to raise awareness of mental health, address the stigma and create positive mental health in and through work.

Support us

Remember, you are not alone, there is always someone to talk to or somewhere to find additional help.

Thank you to James Carter, from Green Man Walks, for your contribution to this blog. James is focussed on addressing the wellbeing gap which exists between a positive society and mental fragility and illness: https://www.greenmanwalks.co.uk/

References:

[1] What is financial wellbeing? | Money and Pensions Service (maps.org.uk)

[3] The Healthier Nation Index (nuffieldhealth.com)

[4] Financial strain causing adults to suffer with mental and physical health - FTAdviser

[5] The current state of financial wellbeing | Employee Experience | HR Grapevine | Insight

[6] What is financial wellbeing? | Money and Pensions Service (maps.org.uk)

[7] Financial strain causing adults to suffer with mental and physical health - FTAdviser

Related News

The latest updates

Featured

Blog: Six tips to optimise your mental wellbeing

This blog aims to provide insights into some of the factors that can impact, both positively and negatively, on our mental health.